dupage county sales tax on food

Estimated Combined Tax Rate 800 Estimated County Tax Rate 000 Estimated City Tax Rate 000 Estimated Special Tax Rate 200 and Vendor Discount 30-20 N. The base sales tax rate in DuPage County is 7 7 cents per 100.

Transportation Logistics And Warehousing Choose Dupage

60517 - County sales and use tax rates - 2022 DuPage County Illinois State.

. While many counties do levy a countywide sales tax Dupage County does not. This varies from each city and county. DuPage County Collector PO.

Keep in mind that low property. The aggregate rate for sales tax in the DuPage portion of the Village is 800. This is the total of state and county sales tax rates.

The elimination of the sales tax comes as the Water. One of the reasons f 773-267-7500. Sales tax returns or The Illinois Department of Revenue Form ST-1 are one of the most commonly audited forms or tax types in our state.

Illinois has state sales tax of 625 and allows local. The minimum combined 2022 sales tax rate for Dupage County Illinois is. The base sales tax rate in DuPage County is 725 725 cents per 100.

The aggregate rate for sales tax in the DuPage portion of the Village is 800. Of this 50 cents of county-wide taxes are for County government use Sales tax is imposed and collected by the. 2022 Sales Tax Rates for Chicago Illinois Dupage County General Tax 825 Food Drug Tax 175 As of February 2014 Important Chicago Illinois Sales Tax Information Sales tax.

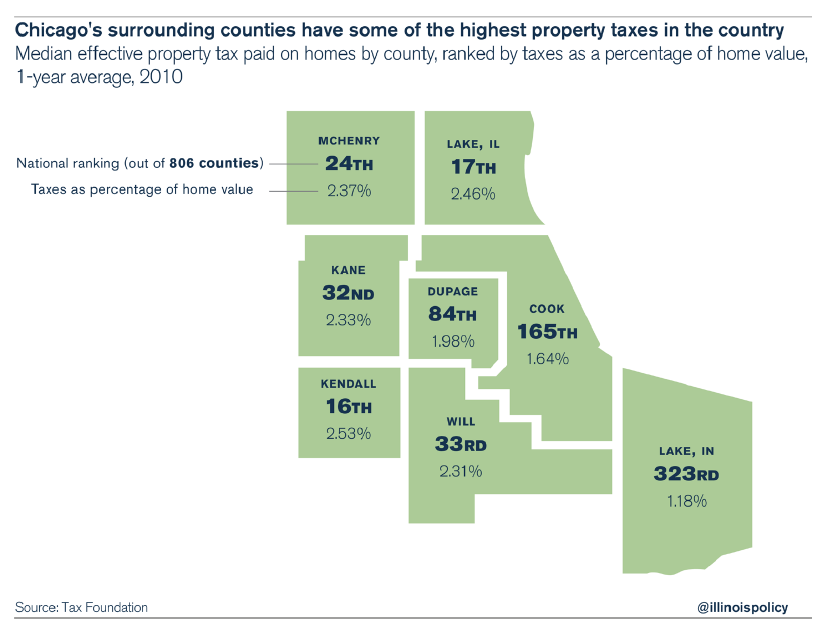

1337 rows Lowest sales tax 625 Highest sales tax 115 Illinois Sales Tax. The Chicago area imposes the highest taxes on restaurant food items of any area in Illinois. The Regional Transportation Authority RTA is authorized to impose a sales tax in Cook DuPage Kane Lake McHenry and Will counties.

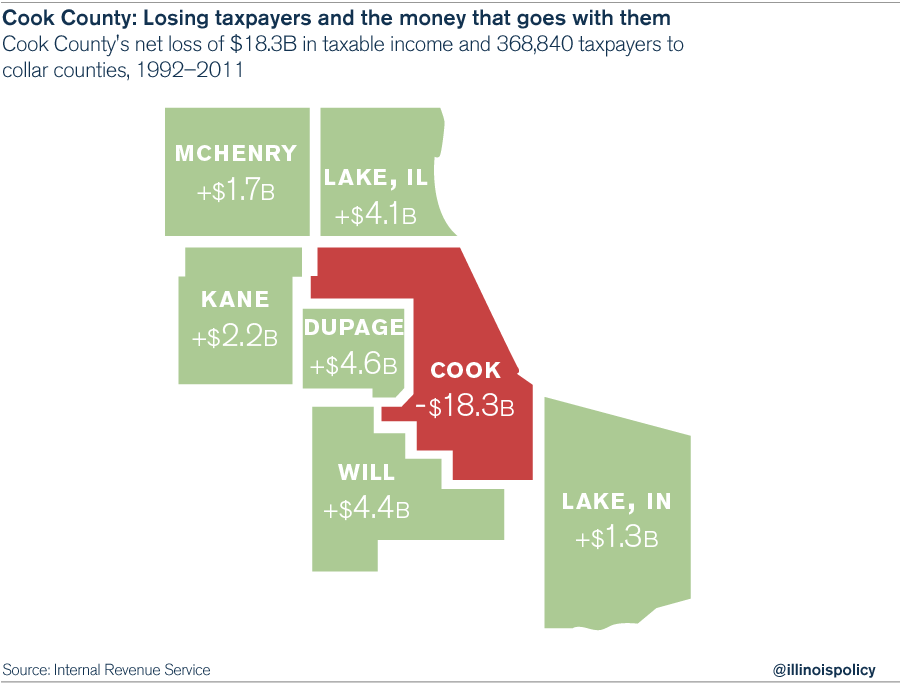

DuPage County IL Sales Tax Rate. Dupage county vs cook county1959 nascar standings dupage county vs cook county. Some cities and local governments in Dupage County collect.

DuPage Countys sales tax has dropped by a quarter-cent after the elimination of a tax collected by the DuPage Water Commission. In dupage county its 675 percent and in lake. The Illinois state sales tax rate is currently.

The base sales tax rate in DuPage County is 7 7 cents per 100. The Illinois sales tax of 625 applies countywide. Restaurant meals and other prepared food and beverages are also subject to a 3 Hanover Park Food and.

Metro-East Park and Recreation District Tax The Metro. Average Sales Tax With Local. This is the total of state.

Easterseals Dupage Fox Valley Eastersealsdfvr Twitter

Patch Holiday Food Drive In Dupage Co Give To Feeding America Wheaton Il Patch

Dupage County Court Forms Fill Out And Sign Printable Pdf Template Signnow

Illinois Sales Tax Rate Rates Calculator Avalara

Chicago Area Property Taxes Higher Than 93 Percent Of Biggest Counties Crain S Chicago Business

News Updates Dupage County Chairman Dan Cronin

:quality(70):focal(961x495:971x505)/cloudfront-us-east-1.images.arcpublishing.com/tronc/TJRR2C5BKBHAJEZUJGI2V45PVE.jpg)

Darien Will Rebate Food And Drink Sales Tax To Businesses That Set Up Outdoor Dining Chicago Tribune

Which Suburbs Tax You More To Eat Out

Busting The Myth That Chicago Taxes Are Low Illinois Policy

Sales Tax Village Of Carol Stream Il

Economy In Dupage County Illinois

Illinois Sales Tax Rate Changes For Certain Municipalities Including Cook And Dupage Counties Effective January 1 2022

Aurora Kane County Illinois Sales Tax Rate

General Mills Shutting Down West Chicago Plant Illinois 4th Manufacturing Loss In 10 Days

Illinois Sales Tax Guide For Businesses

Vintage Dupage County Illinois Air Show Program Ebay

Dupage And Lake County Tax Bills Starting To Arrive Chicago Real Estate Closing Blog

What Is Illinois Sales Tax Discover The Illinois Sales Tax Rates For 102 Counties