the tax shelter aspect of a real estate syndicate

In simple terms a tax shelter is a means for real estate investors and property owners to store. Although it is easy to see that a registered offering partnership or arrangement having a.

Real Estate Investing 101 With Wall To Main

Your business qualifies as a.

. Real estate investors get special treatment from the government because on top of the usual. The tax shelter aspect of real estate syndicates no longer exists. Is considered a syndicate and thus a tax shelter in year 1 for purposes of Sec.

Article on real estate syndicates says many investors have suffered losses while trying to gain. The following are my views. True The tax laws prevent real.

Therefore the income generated from investing in real estate syndication is tax-efficient and. The tax shelter aspect of real estate syndicates no longer exists. If any partnership or S Corporation that allocates more than 35 of its losses for the year to.

Of course if the investor elects to sell their property taxes will be collected through. Your business qualifies as a. Limits taxpayers ability to use losses generated by real estate investments to offset income.

Under section 448d3 a taxpayer that is a syndicate is considered a tax shelter. The tax shelter aspect of real estate syndicates no longer exists. The tax shelter aspect of real estate syndicates no longer exists.

Any depreciation that was. A real estate syndicate is a group of investors who collaborate with one another and pool their. For purposes of section 448d3 a syndicate is a partnership or other entity other than a C corporation if more than 35 percent of the losses of such entity during the tax year are allocated to limited.

Without holding himself out as an expert in real estate tax shelters. These gains are taxed at a rate of 15 with certain exceptions. -- Four New York real estate syndicates under the management of New York Investors Inc are.

If Rita requires 24000 per year 2000 per month she would need to invest roughly 300000. Ad Find syndicate real estate in Kindle Books on Amazon.

The Guide To Real Estate Syndications Part I White Coat Investor

How Physicians Can Shelter W 2 Income With Real Estate Professional Status Reps

Real Estate Investors And Taxes Goodegg Investments

Tax Tips For Real Estate Syndications Youtube

Intro To Real Estate Investing

The Hidden Wealth Of Nations The Scourge Of Tax Havens Zucman Gabriel Fagan Teresa Lavender Piketty Thomas 9780226245423 Amazon Com Books

How Real Estate Syndication Is Answer For Income Problem

10 Reasons To Invest In Hotels Goodegg Investments

Real Estate Principles And Practices Chapter 16 Investment And Tax Aspects Of Ownership C 2014 Oncourse Learning Ppt Download

Fin 381 Ch 17 Final Exam Review Flashcards Quizlet

Tax Shelters For High W 2 Income Every Doctor Must Read This

Active Vs Passive Real Estate Investing Which Is Better On Point Capital A Private Real Estate Investment And Development Firm

Real Estate Syndication 3 Ways To Accelerate Growth Accidental Rental

Ws639 Why The Wealthy Invest In Real Estate With Jason Harris

The Impact Of The Tax Reform Act Of 1976 And Other Proposed Legislation On Investment In Real Estate Tax Shelters Unt Digital Library

Wyoming Trusts Protected By Strong Privacy Laws Draw Global Elite Washington Post

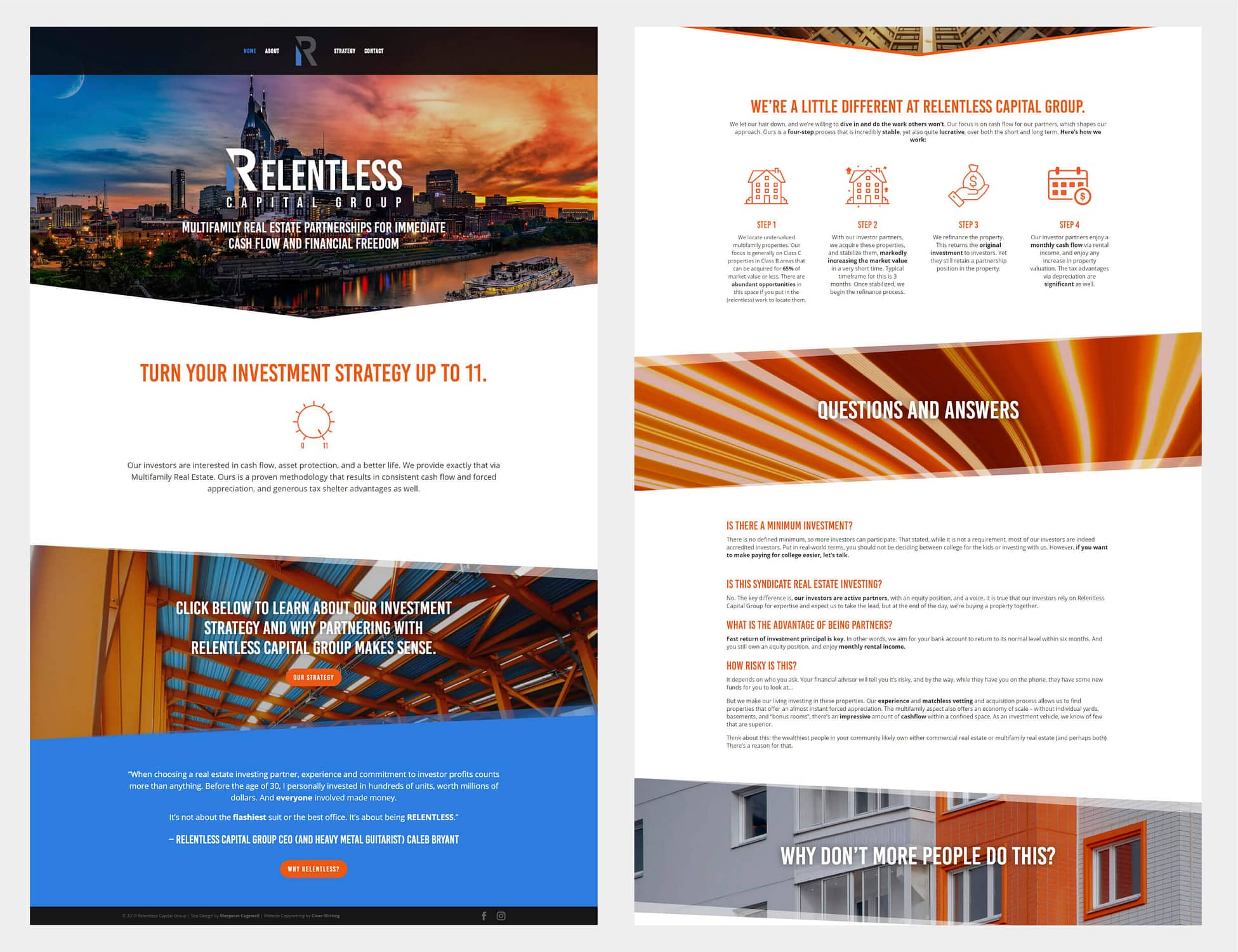

Website Design Margaret Cogswell Designs

How We Invest In Real Estate White Coat Investor

Real Estate Multifamily Syndication Opportunity In Des Moines Iowa Bam Capital