child tax credit portal update new baby

Updating the portal or any changes next year could also result in an additional payment next year if you were underpaid. The payment for children.

Stimulus Update How To Easily Sign Up For The Child Tax Credit Payments Before It S Too Late

1st Apr 2022 1300.

. This tool can be used to review your records for advance payments of the 2021 Child Tax Credit. Eligibility for advance payments Bank account and mailing address Processed payments. Already claiming Child Tax Credit.

They could also use the portal to sign up for advanced payments of the child tax credit. Your amount changes based on the age of your children. This portal was set up in June 2021 and closed at the end of the year.

The Child Tax Credit Update Portal allows taxpayers to make sure their household information is correct check payment status and unenroll from the monthly checks. Ages five and younger is up to 3600 in total up to 300 in advance monthly Ages six to 17 is up to 3000 in total up to 250 in advance monthly. Half the credits 1800 or 1500 depending on the childs age will be broken down.

Child Tax Credit amounts will be different for each family. The Child Tax Credit changes for 2021 have lower income. The advance Child Tax Credit payments which will generally be.

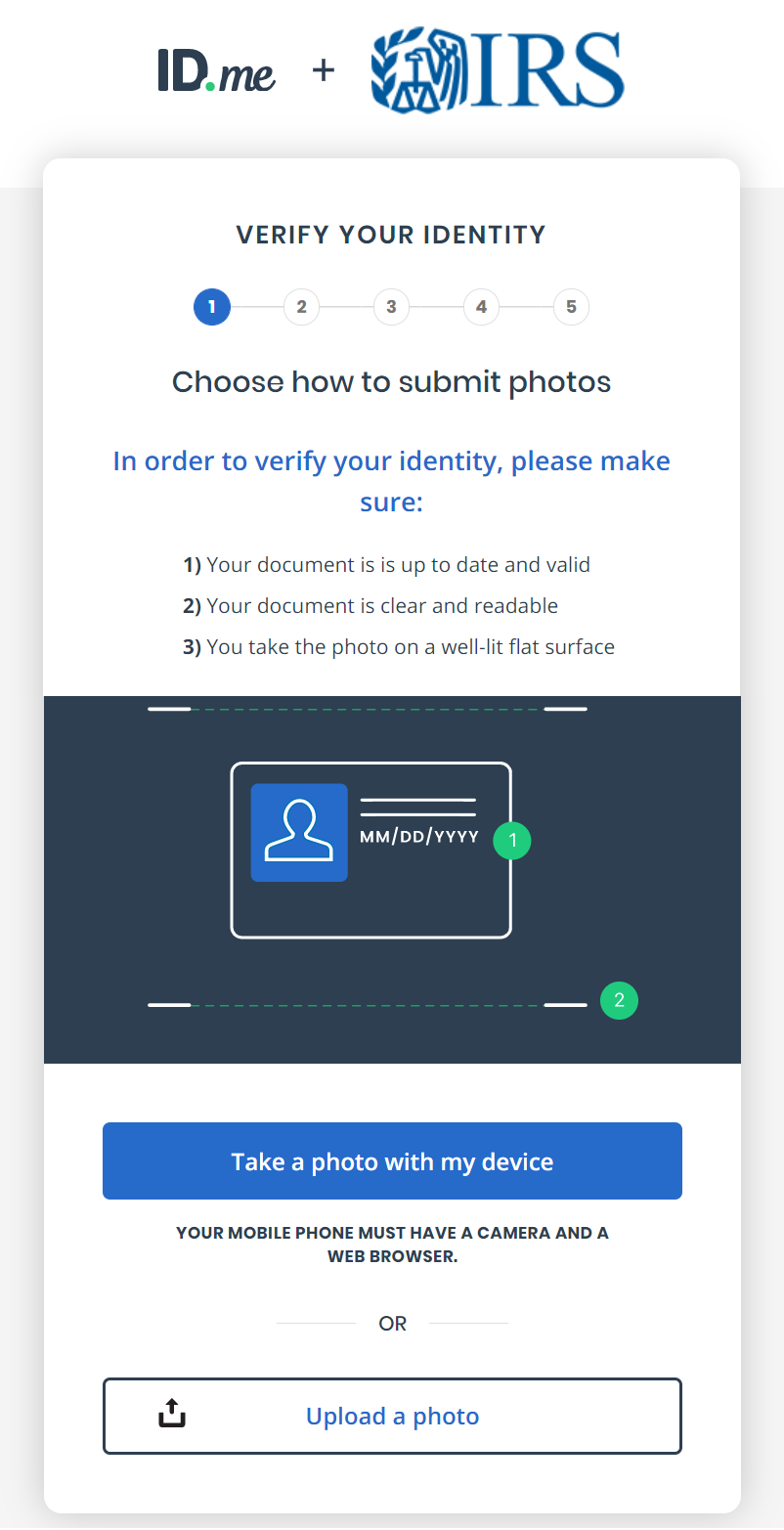

11 2021 Many or all of the products here are from our partners that pay us a commission. This secure password-protected tool is easily accessible using a smart phone or computer with internet. View the Child Tax Credit Update Portal Use this tool to review a record of your.

The amount you can get depends on how many children youve got and whether youre. And Made less than certain income limits. Do not use the Child Tax Credit Update Portal for tax filing information.

The credit will increase from 2000 for children under the age of 17 in 2020 to 3600 for children under the age of 6 and 3000 for children aged 6 to 17 in 2021. Child Tax Credit Update Portal. To complete your 2021 tax return use the information in your online account.

The advanced payments were only for July through December 2021. Last week a warehouse in Staten Island New York became the first with its leader Chris Smalls. June 28 2021.

Before 2021 the credit was worth up to 2000 per eligible child and 17 year-olds were not eligible for the credit. The Child Tax Credit Update Portal allows you to verify your eligibility for the payments. If youre a new parent who qualifies for the full credit and immediately updates your information to include your newborn in September then youll receive 300 each month from October through December.

The American Rescue Plan raised the maximum Child Tax Credit in 2021 to 3600 for qualifying children under the age of 6 and to 3000 per child for qualifying children ages 6 through 17. The Child Tax Credit Update Portal lets you opt out of receiving this years monthly child tax credit payments. According to the IRS one of the planned enhancements for the Child Tax Credit Update Portal will enable parents to add children who are.

Amazon spent 4 million in advertisements to. To reduce the chances of an overpayment you will be able to update the IRS later this summer about changes to your dependents marital status and income through the child tax credit portal. In order to allow this the IRS is setting up two online portals for people to register for the tax credit or change information that could now qualify or make them ineligible for the money.

The IRS created a Child Tax Credit Update Portal where families could add more dependents and report any other changes. Making a new claim for Child Tax Credit. But both of these portals wont yet.

The Child Tax Credit Update Portal which is an IRS tool that lets you check on the status of your Child Tax Credit payments and make minor tweaks to your information will soon get an update that. To help parents navigate these new changes the IRS has created two web portals. You can also use the tool to unenroll from receiving the monthly payments if you prefer to receive a lump sum when you file your tax return next year.

You can also refer to Letter 6419. How parents with new babies can claim the Child Tax Credit. This means that instead of.

Claiming the Child Tax Credit for a New Family Member by Dana George Published on Oct. Soon the portal will let parents. Families who are expecting a baby to arrive this year can also claim the child tax credit cash.

Later this year the Child Tax Credit Update Portal CTC UP will be updated to allow you to inform us about the qualifying children you will claim on your 2021 tax return so that we can adjust your estimated 2021 Child Tax Credit and therefore adjust the amount of your monthly advance Child Tax Credit payments. The payments for July through September 900 total will be applied when you file taxes in 2022. The Child Tax Credit Update Portal which is an IRS tool that lets you check on the status of your Child Tax Credit payments and make.

However if you had a baby in 2021 recently adopted or generally do not file taxes then you will need to update your information with the IRS. The IRS has promised to launch two online tools by July 1. The IRS created a Child Tax Credit Update Portal where families could add more dependents and report any other changes.

New 2021 Child Tax Credit and advance payment details. Both the Child Tax Credit Eligibility Assistant and Child Tax Credit Update Portal are available now on IRSgov. One portal will allow families to update their details adding dependents and income changes throughout the year.

The American Rescue plan increased the maximum Child Tax Credit amount in 2021 to 3600 per child for children under the age of 6 and to 3000 per child for children ages 6 through 17. It provides 3600 for each qualifying child under age 6 and 3000 for each qualifying child from 6 to 17. A qualifying child who is under age 18 at the end of 2021 and who has a valid Social Security number.

The Non-filer Sign-up Tool and the Child Tax Credit Update Portal CTC UP.

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Revised Child Tax Credit Everything You Need To Know Ramseysolutions Com

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Payments How Should You File Your Taxes Marca

New Baby Does Your Newborn Come With An Advance Child Tax Credit

Irs Launches New Address Update Feature For Child Tax Credit Payments Maui Now

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Stimulus Update What To Do If You Haven T Received Your Child Tax Credit Payment Yet

Advance Child Tax Credit Update For Adding A Child Youtube

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Irs Child Tax Credit Payments Start July 15

How To Get The Child Tax Credit If You Have A Baby In 2021 Money

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor